What is Money?

That’s a great question. In fact, very few people truly understand the definition of ‘money.

Since it is something essential to our lives, it’s important to understand it accurately.

In this article, we will comprehensively explain everything from the definition of money to its role.

Read to the end and gain a solid understanding of money.

What Is Money? A Simple Explanation of Its Definition, History, and Role

We use “money” every day. But have you ever thought about its essence? In this article, we’ll provide a clear explanation of the definition, origins, and modern roles of money.

What Is the Definition of Money?

Money is a “medium of exchange” used to trade goods and services. More specifically, it serves as a tool to facilitate economic activity and has the following characteristics:

- Store of Value: A means to preserve wealth over time.

- Medium of Exchange: A tool that enables easy trade of goods and services.

- Unit of Account: A standard measure for determining the value of things.

In other words, money functions as a universal rule that keeps economic systems running smoothly.

The History of Money: From Barter to Cash

In a time before money existed, people relied on barter. For example, one might trade livestock to obtain crops. However, bartering had significant inconveniences, such as:

- Value Mismatch: Transactions couldn’t occur if both parties didn’t have what the other wanted.

- Storage Challenges: Perishable items made long-term storage difficult.

To resolve these issues, “money” was invented. Early money included items like shells, stones, and metals that had universal value. Later, metal coins and paper currency emerged, and today, money has evolved into digital forms.

The Role of Money in Modern Times

Today, money is more than just a “means of payment.” It underpins the entire economic system and fulfills the following roles:

- Facilitating Economic Activity: Ensures smooth transactions between individuals and businesses.

- Transferring Value: Creates future value through saving and investing.

- Providing a Foundation of Trust: Stabilizes the economy based on trust in banks and governments.

Money is indispensable in our lives and economic activities. Understanding its mechanisms is the first step toward living a more prosperous life.

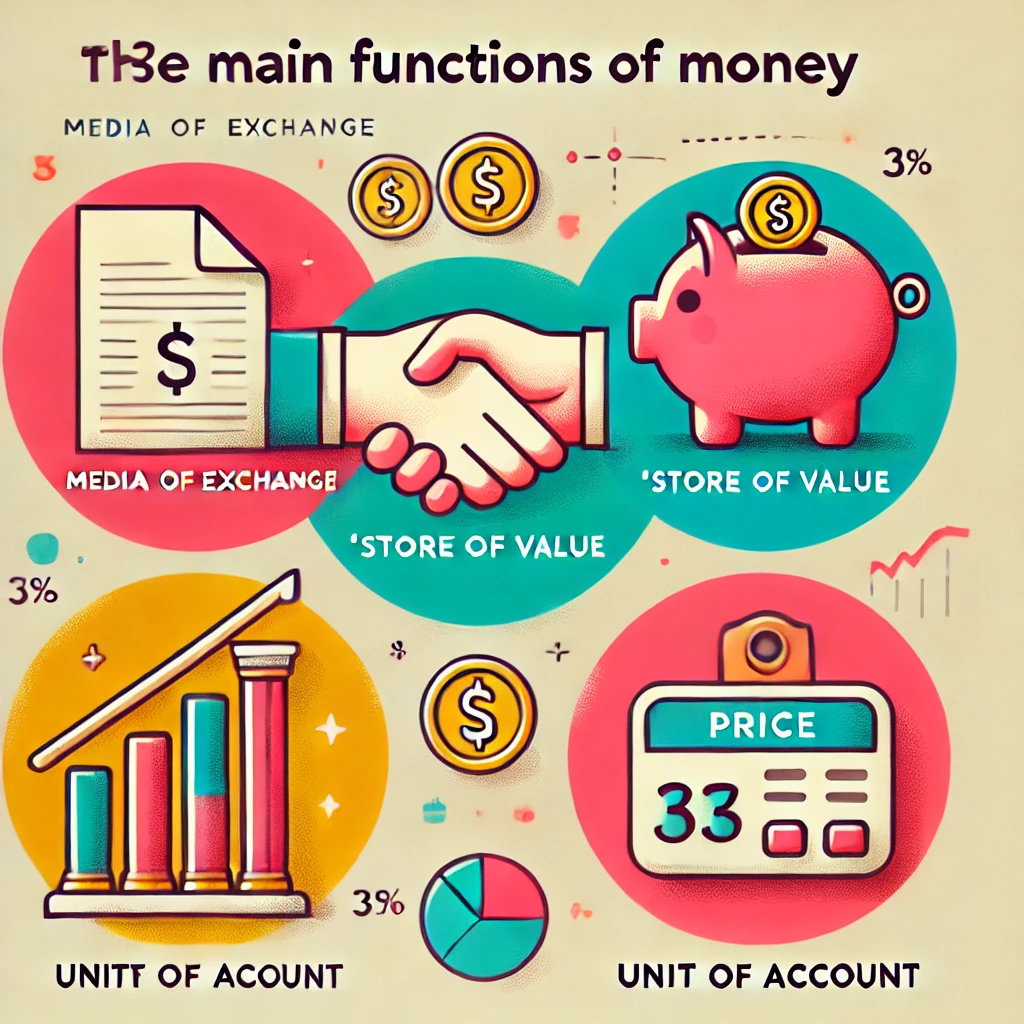

The Three Functions of Money: Medium of Exchange, Store of Value, and Unit of Account

Money, which we use daily, serves a much more significant purpose than merely being a “means of payment.” To help beginners understand, let’s break down the three fundamental functions of money that keep the economy running smoothly and support our daily lives.

1. Medium of Exchange

The primary function of money is to act as a medium of exchange.

In ancient societies, bartering was the standard method of trade, but it was highly inefficient. For instance, if you wanted to trade rice for fish, the transaction wouldn’t happen unless both parties’ needs aligned perfectly. With the introduction of money, goods and services could be converted into a common value, making trade much easier and more flexible.

Examples:

- Using cash or a card to buy vegetables at a supermarket

- Paying a monthly subscription fee for a service

This function ensures that our daily lives and economic activities proceed smoothly.

2. Store of Value

Money also serves the crucial function of storing value. In a barter system, perishable or fluctuating-value goods carried the risk of losing their worth. Money, however, retains its value over time and can be saved for future use.

Examples:

- Depositing money in a bank account for later withdrawal

- Saving for a major purchase or investment in the future

This function allows people to manage their assets effectively and maintain economic stability.

3. Unit of Account

Money acts as a unit of account, providing a standard for measuring the value of goods and services. This makes it possible to compare the value of different products or services.

Examples:

- If a cup of coffee costs 300 yen and a movie ticket costs 1,500 yen, you know that one movie is equivalent to five cups of coffee in value.

- Evaluating high-value items like real estate or cars based on their monetary price.

This function enables us to make rational decisions and enhances transparency across the economy.

The Economic System Created by These Three Functions

These functions combined make money more than just “paper” or “coins”—it becomes the foundation of society. By facilitating exchanges, preserving value, and enabling accurate comparisons, money supports the complex transactions that drive the economy.

Understanding how money works is the first step toward managing it wisely. In the next article, we’ll delve deeper into practical ways to manage and use money effectively.

Types and Forms of Money: From Cash to Digital Currency

When you hear the word “money,” you probably think of paper bills and coins. However, in today’s world, the forms of money have diversified significantly. This article provides a beginner-friendly explanation of the types and forms of money, from traditional cash to cutting-edge digital currencies.

Cash: Paper Bills and Coins

Cash is the most common and historically oldest form of money.

Paper bills and coins are issued by governments or central banks and are legally guaranteed to hold value.

Key Features:

- Convenience: Suitable for small transactions.

- Anonymity: Transactions are not traceable to individuals.

- Physical Limitations: Requires space for carrying and storage.

Cash remains essential, particularly for small-scale transactions and payments in rural areas.

Bank Deposits: Money in Your Bank Account

Beyond cash, the most representative form of money is bank deposits.

We manage and use money without physical cash through bank accounts.

Key Features:

- Security: Lower risk of theft or loss.

- Convenience: Accessible via cards or apps.

- Interest: Some accounts offer interest on deposits.

For instance, bank deposits are used for debit card payments and wire transfers.

Electronic Money: The Rise of Cashless Payments

Electronic money refers to money managed as digital data.

Examples include Suica, PayPay, and other systems that allow quick payments via smartphones or cards without physical cash.

Key Features:

- Fast Transactions: Payments are completed in seconds.

- Portability: Managed via smartphones or IC cards.

- Reward Systems: Some services offer points or benefits with use.

Electronic money is widely used for small transactions due to its high convenience.

Digital Money and Cryptocurrencies: The Future of Money

Recently, blockchain-based cryptocurrencies and central bank-issued digital currencies (CBDCs) have gained attention.

Cryptocurrencies (e.g., Bitcoin, Ethereum):

- Decentralization: No central authority.

- Investment Potential: Highly volatile in value.

Central Bank Digital Currencies (CBDCs):

- Government-Issued: Trusted as legal tender.

- Financial Inclusion: Usable even without a bank account.

These forms of digital money are expanding globally and could revolutionize the economy in the future.

Why Money Is Diversifying

The diversification of money is driven by technological advancements and changes in our lifestyles.

As convenience is prioritized, new forms of money are continually emerging to replace traditional cash.

Understanding the various types and forms of money can expand your options for daily life and investments. In the next article, we will delve deeper into how to use each type of money effectively.

The Important Role of Money: Its Impact on Our Lives

Money is not just a “means of payment”; it profoundly influences our lives and society as a whole. In this article, we’ll explore the vital roles money plays and its impact in a way that’s easy for beginners to understand.

1. How Money Impacts Our Daily Lives

Money is indispensable in every aspect of daily life. Here are some specific roles it plays in our lives:

- Purchasing Essentials: Money is required to meet basic needs such as food, housing, and clothing.

- Investing in Education and Health: Covers expenses like tuition and medical bills, helping expand opportunities and maintain well-being.

- Enabling Leisure Activities: Provides the means to enjoy hobbies, travel, and entertainment.

With money, we gain more choices and the ability to pursue a richer and more fulfilling life.

2. The Role of Money in Society

Money supports not only our personal lives but also plays a crucial role in society as a whole:

- Promoting Economic Circulation: Money flows between individuals and businesses, stimulating economic activity.

- Funding Public Services: Money collected as taxes is used for schools, hospitals, roads, and other public services.

- Reducing Poverty: Proper distribution of funds can reduce inequality and improve the overall standard of living.

When money functions efficiently, it contributes to societal stability and progress.

3. Challenges Associated with Money

While money offers many benefits, it also presents challenges:

- Widening Gaps: Significant disparities in living standards can arise between those who have money and those who don’t.

- Risks of Waste and Debt: Without proper planning, people may fall into wasteful spending or debt.

- Emotional Stress: The stress of not having enough money can negatively affect quality of life.

Addressing these challenges and learning to use money wisely is essential.

4. How Money Management Can Transform Life

How we use money has a significant impact on our lives. Proper money management provides the following benefits:

- Preparing for the Future: Savings and investments can reduce uncertainty and provide security.

- Freedom and Peace of Mind: Having financial leeway increases options and provides a sense of security.

- Contributing to Others: Donations and social contributions allow individuals to positively impact society.

Understanding the role of money and using it wisely is the key to building a fulfilling life.

By understanding how money affects our lives and society, we can better appreciate its value. Let’s continue to build our knowledge of money for a free and prosperous future.

Summary

Money is truly profound, isn’t it?

That’s right. We use it every day without much thought, but it’s actually something very difficult to manage.

In this article, we explained the definition of money.

Let’s gain accurate knowledge and learn to use money wisely.

コメント